This is a story about my experience selling my furniture on craigslist.

My daughters graduated high school and left home for college. I decided to sell their used furniture.

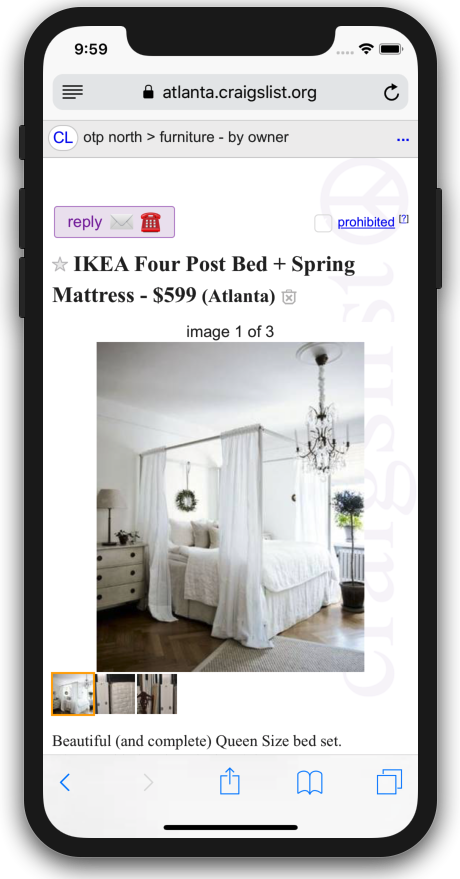

First, I posted this ad on craigslist:

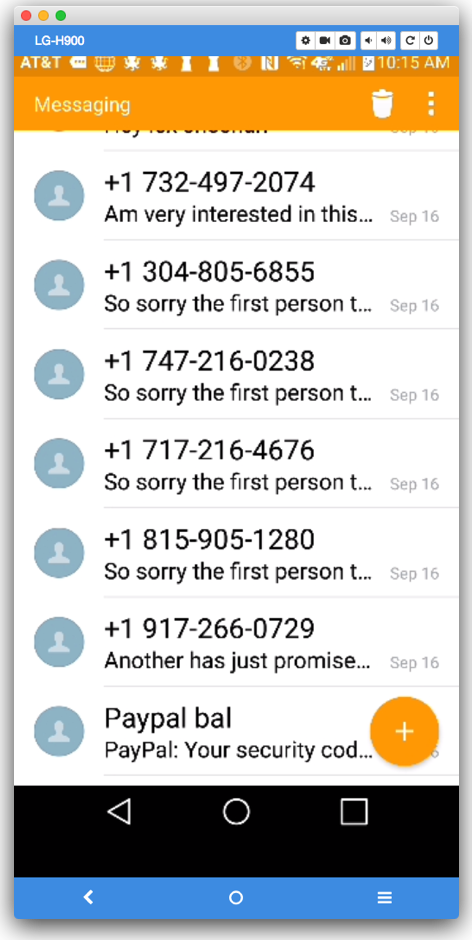

Moments later, I began to receive these text messages:

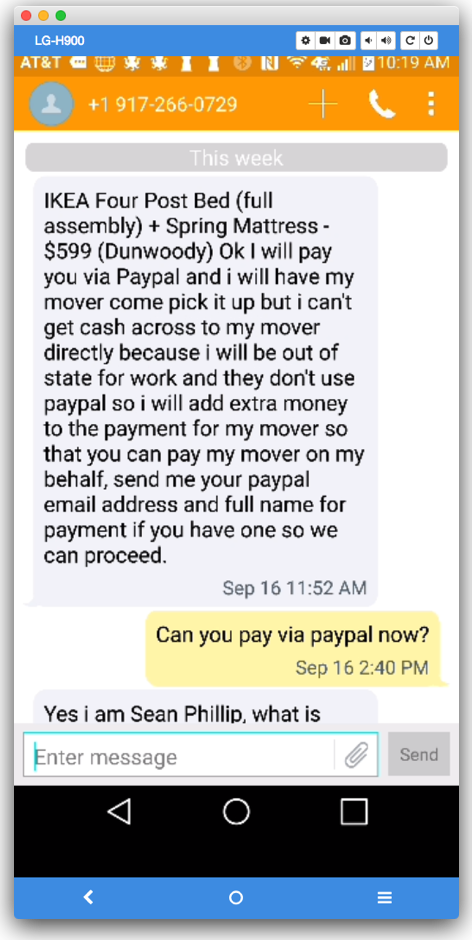

Let’s look at the first one:

That seemed legit. Sean Phillip gave me his name and said he was ready to pay with PayPal immediately.

How to Lose Money Using PayPal

I looked into the issues doing business with a stranger using PayPal. Here’s what I found:

When we enter into a transaction like this, PayPal takes the money ($599 + movers expenses) and puts that money in “escrow”. Escrow is just an account that holds the money until PayPal is convinced that both parties upheld their part of the deal.

The buyer puts their money in the escrow account. The seller sees the money and then is responsible for shipping the furniture to the buyer.

Looks simple and safe. But, looks can be deceiving…

PayPal will only deem the furniture shipped if the seller ships the furniture and gets a tracking number from UPS/Fedex. However, that will cost at least $300; possibly thousands, depending on the amount of furniture to ship.

Since the seller cannot get any money until the buyer receives the furniture that won’t happen. So, the buyer will claim to have his movers pickup the furniture, which won’t happen either. Remember, this is a scam and the buyer is really only after the seller’s money.

Time goes by and the seller gets desperate; he’s told other prospective buyers that the furniture is already SOLD.

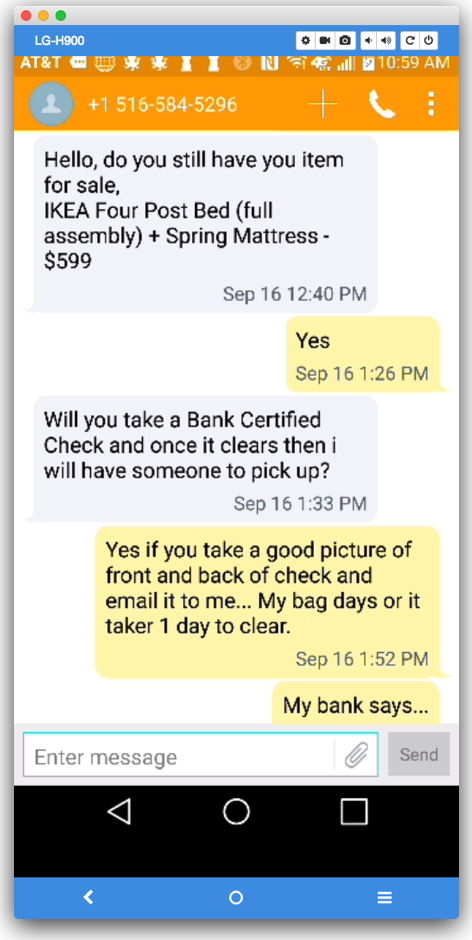

The buyer says he’ll send a check and by this time, the seller is motivated to accept it.

The Scammers’ Angle

The scammers’ angle is to get the central banking system involved because the banking system is flawed and the scammers can use those flaws to get the seller’s money.

Your bank will never lose (their) money, but they will charge you when you lose your money.

The Check Scam

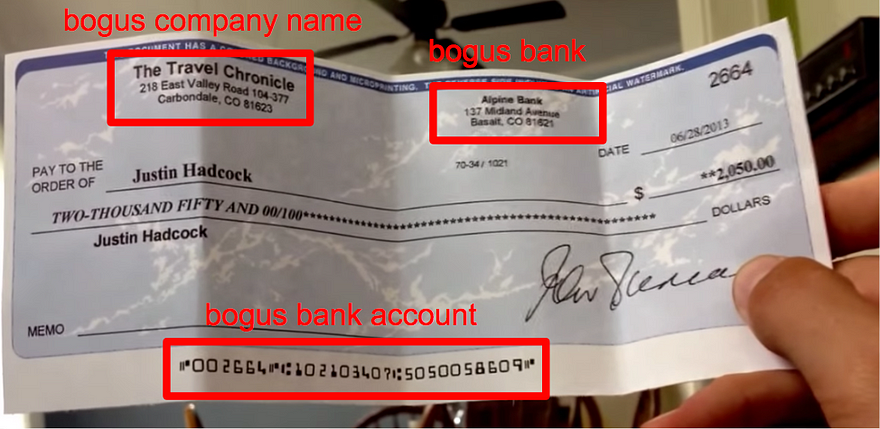

It starts when the scammer gets you to agree to take a check.

Here’s how they do it:

- Seller agrees to accept a check.

- Buyer sends mover to pickup the furniture.

3. Seller receives a check for more than the cost “to cover moving expenses”.

4. Seller pays movers with their money $2,050 (to ship his furniture to a bogus person at a bogus address).

5. Seller sends extra $1,550 (the difference between amount of bogus check amount and how much the movers actually cost) to the buyer via Western Union.

Where The Money Goes

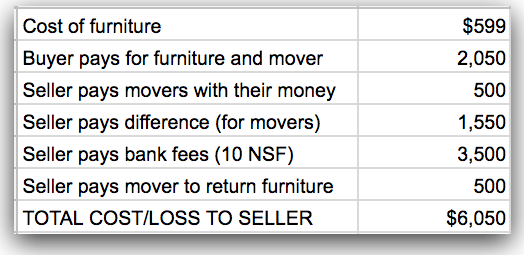

All the amounts below could be real (and happen to you), except for the $2,050 (bogus) check from the buyer:

- The buyer (scammer) makes $1,550.

- The seller loses $6,050 (but still has his $599 furniture).

- Your bank makes $3,500

The buyer does have some risk of getting caught, the mover makes a profit but has to work for it. Your bank makes out like a bandit and you’re left paying for it all.

Your bank will never lose (their) money, but they will charge you when you lose your money.

When the check clears and the seller sees the $599 credited to his bank account, he writes other checks assuming the balance that the bank claims is accurate is actually correct.

In this example, the seller’s bank account balance was just over $0.00 before the $599 clears. Suppose the seller trusts the bank’s report of his balance and makes 10 small purchases that subsequently all bounce. (Many banks give you immediate access to $200 from any check.)

The bank then charges the seller $35 for each of the 10 bounced checks ($3,500).

Suppose your (the seller) didn’t write any additional checks and have no NSF fees, you’ll still have to pay the movers $1,000 and you’ll still loose the $1,550 you paid the scammer. Plus, there will be a bank fee for “processing” a returned check. Also, this is not the only scenario where scammers (and banks) take advantage of sellers.

The Cost of the Middleman

None of this loss of money would happen if you, the seller, accept cash or cryptocurrency only. If you think that getting your bank involved in your transaction protects you, think again.

How bankers do it…

Bankers do it for a fee.

Bankers do it risk-free.

Bankers do it with glee.

The Real Cost

Let’s not forget your time lost communicating with the scammers, movers, PayPal and your bank representatives. Also, any NSFs may result in a negative impact to your credit rating, which will drive up all sorts of costs, including but not limited to new mortgage rates, insurance, college loans, ability to rent, etc. That could mean loss of opportunity and much more than your current $6,050 loss.

Our Banking System Enables Scammers

First, we must understand that banks are not in business to help consumers.

Banks exist to make a profit. Banks are like a monopoly that makes the rules, controls the rules and then decides how much to charge you when they can catch you breaking any of the rules (that are stacked against you).

Banks use deception to lure consumers into thinking that the account balances and transactions are real. Clearly, the only things you can count on are banks fees.

Dolor Emptor

I wonder how many check scams are instigated by the banking system. After all, who is guaranteed to profit (and never get caught)?

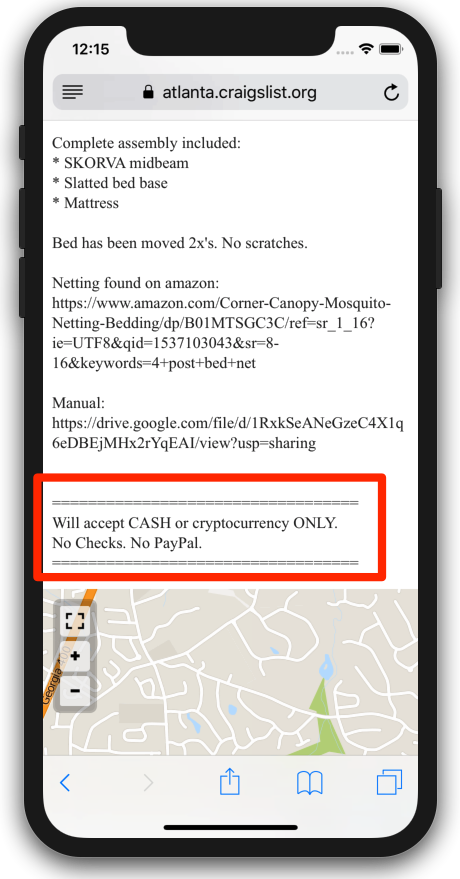

Craigslist — Will accept Cryptocurrency!

I added the following to my ad to reduce contact from scammers:

==================================

Will accept CASH or cryptocurrency ONLY.

No Checks. No PayPal.

==================================

Will accept CASH or cryptocurrency ONLY.

No Checks. No PayPal.

==================================

Today’s reality is that only 5% of people use cryptocurrency. So, accepting cash is still a necessity on craigslist.

Lessons Learned

- Do not trust your bank account balance

- Do not accept checks from a stranger

- Do not accept PayPal payments from a stranger

- Do accept cash or cryptocurrency from anyone

- Do use common sense

Who would pay over a $1,000 dollars to move furniture that’s only worth $599?

Go to the effort of tracking all of your deposits and credits separately from your bank’s account records. (Do not trust your bank’s version of your account balance.)

Other Financial Risks Sellers Face

If you accept PayPal or credit cards (Visa, MasterCard, etc.) you have to be concerned with charge backs. That’s when the buyer claims that what you sold them is not what they expected. Buyers are protected, not the seller.

If you are dealing with a dishonest buyer, they’ll do or claim anything to get money and possibly return damaged merchandise, if you’re lucky. Your credit will be affected and your rates will go up and you might get dropped from your bank’s merchant program.

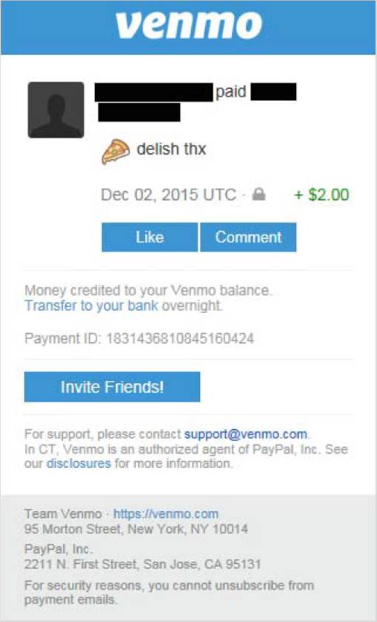

What about Venmo?

You’re not safe accepting Venmo payments either.

Read Venmo’s User agreement closely:

“Business, commercial, or merchant transactions may not be conducted using personal accounts.”

Scammers are exploiting a flaw in the Venmo system.

There is a gap between when you see the “Money credited to your Venmo balance. Cash out to your bank overnight.” and when you actually receive your money.

So, if you (the seller) read that “Money credited to your Venmo balance.” and think it’s safe to give your goods/services to the buyer, but if that buyer is a scammer, the next notification you’ll get will say ‘Your transaction has been reversed. ” and you’ll have no recourse.

The Flaw

Our banking system, PayPal and Venmo share the same flaw. It’s based on the business need to meet end user/buyer expectations. Buyers want to get what they want when they pay for it.

Using checks and Venmo only works if the buyer is honest.

The reality is that neither the current banking system or Venmo (or PayPal for that matter) can actually handle immediate transactions.

Their systems require “processing” time.

Scammers find ways to exploit the gap in what we think happens and what actually happens.

The main difference is that when we use banks, we not only lose money, but we also get penalized with banking fees.

The Solution

We need a system of exchange that can either eliminate that “processing” gap or make it so small and/or so secure that even the most wily scammer is unable to game it.

I wonder what that system would look like?

Take my class and find out…

Hope to see you in class! — Lex Sheehan

Terkadang kartu domino jadi teman dekat untuk isi waktu lengang saja atau untuk bersenang-berbahagia dengan teman dekat

ReplyDeleteasikqq

dewaqq

sumoqq

interqq

pionpoker

bandar ceme terpercaya

hobiqq

paito warna oregon

syair hk

datahk

ReplyDeleteWOW,Thats Great,Your post is very interested.Iam so happy to visited your blog site,

Fbadsaccounts,googlereviews